work from home tax allowance

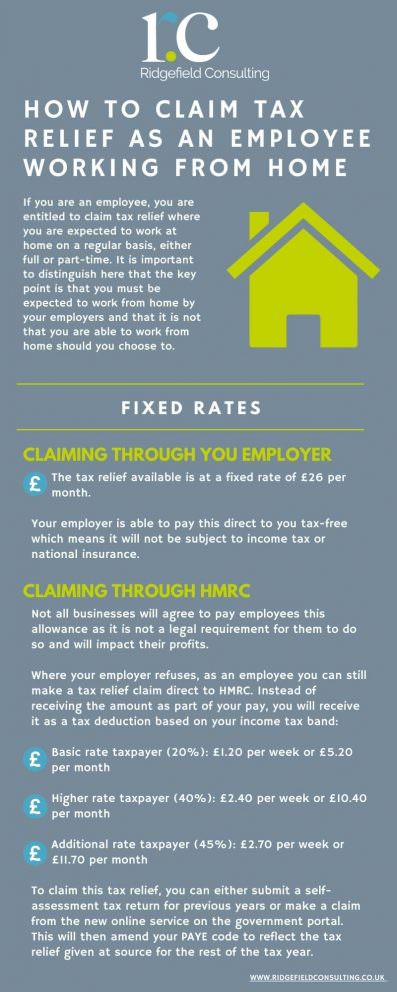

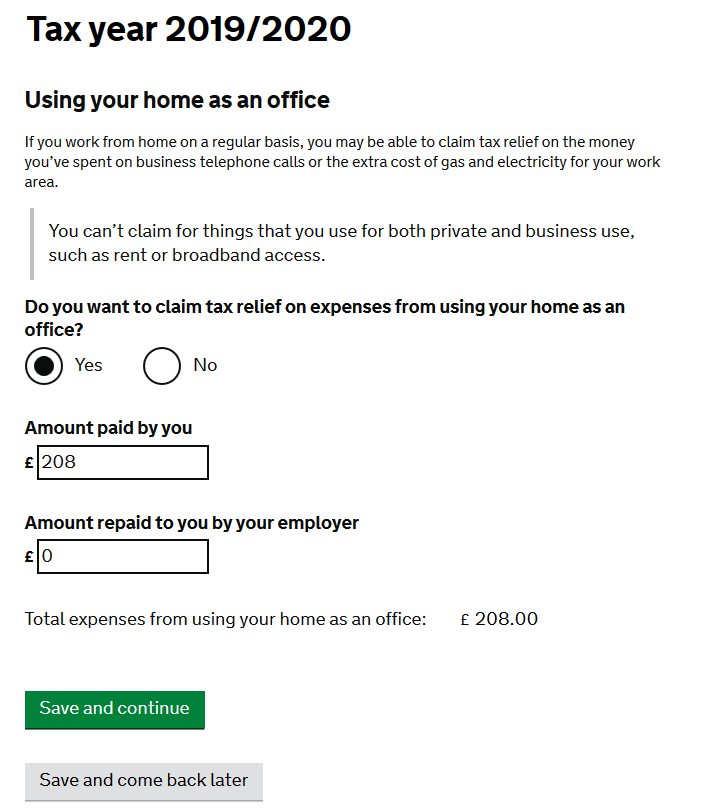

You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. Work from home on such a large scale is an evolving concept and hence the employer would have to build robust policies to tackle the tax exposure both from the corporate as well as individual perspective.

Different Ways To Claim Tax Relief When Working From Home

Available 24 hrs 7 Days A Week.

. Romneys plan would replace the existing Child Tax Credit CTC which is subject to a minimum income requirement and other limitations with a nearly universal child allowance that would be administered through the Social Security Administration SSA rather than the tax code. Rishi Sunak is expected to close HMRCs work from home relief a. That means you can earn a total of 14500 in tax-free allowances.

A relaxed tax-break that pays employees 125 for working from home will come to an end this year it has emerged. This allowance is in addition to your personal allowance of 12500. 12500 from your personal allowance and 2000 from your.

Your dividend tax allowance is the amount you can earn tax-free from dividends. Were The Real Tax Attorneys. Learn about the what qualifies car allowance as a taxable source of income.

Car allowance is a nice employee benefit but can be confusing while filing taxes. This new child allowance would be more generous than the CTC by increasing the payment. The policy and its strict adherence can form a strong evidence for employer to grant these benefits free of tax to their employees and help in case of audit.

This includes if you have to work from home. The dividend allowance in the UK for the 202021 tax year 6th April 2020 to 5th April 2021 is 2000.

Different Ways To Claim Tax Relief When Working From Home

Working From Home Tax Deductions Covid 19

You Can Claim 4 A Week Tax Back If You Work From Home Finance Business Economics And Finance R Ukpersonalfinance

Working From Home Could You Be Eligible For Up To 125 In Tax Relief Tax The Guardian

Working From Home Tax Relief How To Claim Tax Relief

How Do You Claim Working From Home Tax Relief Bluespot Furniture Direct

You Can Now Claim For The Entire Years Work At Home Allowance Before The End Of The Tax Year R Ukpersonalfinance

0 Response to "work from home tax allowance"

Post a Comment